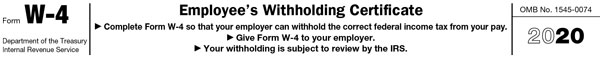

The 2020 Tax Form W-4 (Employee’s Withholding Certificate) is very different from previous versions. This is due to the federal tax law changes that took place in 2018. The Internal Revenue Service (IRS) is not requiring all employees to complete the revised form and has designed the withholding tables so that they will work with both the new and prior year forms.

Albemarle County Payroll staff does not provide tax or legal advice, including fielding questions related to tax forms. We recommend employees reference IRS resources or consult with their personal tax accountant for guidance. For your convenience, below are IRS resources you may find helpful:

- FAQs on the 2020 Form W-4

- Tax Withholding Estimator

- Tax Questions: 1-800-829-1040 (1-800-829-4059 for TTY/TDD)

- Forms and Publications: 1-800-829-3676 (1-800-829-4059 for TTY/TDD)

If you do not submit a new 2020 Form W-4 to payroll, withholding will continue based on your previously submitted form in alignment with the updated IRS tax tables. Even without submitting a new W-4, the new tax tables may drive an impact to your paycheck. You may access your earning statement in Greenshades. If you have issues with accessing or logging into Greenshades, please email helpdesk@albemarle.org or call 434-296-5895.

Even though the IRS does not require all employees to complete the revised form and even if your tax situation has not changed, we recommend you perform a “paycheck check-up” to see if you need to make adjustments to your current withholding (IRS Tax Withholding Estimator).

Select employees are required to use the 2020 Tax Form W-4: employees first paid in 2020 and anyone who makes withholding changes during 2020. Before completing the 2020 Form W-4, please read the instructions that are included with the form. You must complete Steps 1 and 5. Complete Steps 2 through 4 only if they apply to you. Doing so will make your withholding more accurately match your tax liability.

If you have tax questions, please contact the IRS or your tax advisor.