If you read last week’s edition of benefits FOCUS, you learned that our upcoming Open Enrollment window is JUNE 1 through JUNE 15. Open Enrollment is the ONE time each year when you can enroll in or make any/all changes you wish to your current medical/dental plan elections, as well as enroll in a new Flexible Spending Account (FSA) for next year. Remember: You have to enroll annually in an FSA if you want to participate! Any changes you make during Open Enrollment will not go into effect until the start of the new plan year (September 1st for the FSA and October 1st for medical/dental). A link to the Open Enrollment site, along with a link to our special Open Enrollment information site, will be provided to you prior to June 1st.

During Open Enrollment, ALL benefits-eligible employees must log-in to the Open Enrollment site, review your information, make changes (if you wish), then hit the CONFIRM button to save your visit—even if you are NOT on our medical or dental plans or have a Flexible Spending Account (FSA), and even if you don’t plan to participate next year. We’ll tell you WHY this is so important in an upcoming edition of the benefits FOCUS!

What’s the BIG news?

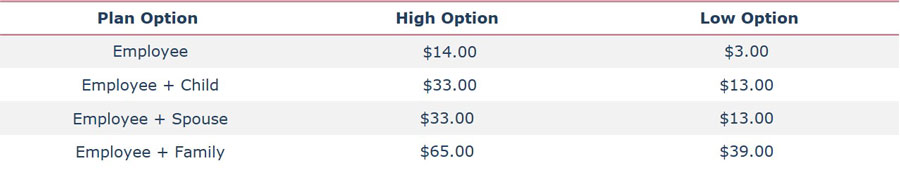

The following medical plan rates (full-time, 12-pay schedule) will be effective on October 1, 2015:

The following changes to the plan will be made, effective on October 1, 2015:

Changes to Plus Plan:

- Increase annual deductible to $500 indiv/$1000 family

- Increase annual out of pocket maximum to $3,000 indiv/$6000 family

Changes to Basic Plan:

- Increase annual deductible to $500 indiv/$1000 family

- Increase annual out of pocket maximum to $3,500 indiv/$7000 family

Dental:

There will be no changes to the DENTAL plan design or employee rates. We are moving to an enhanced network that will offer access to a greater number of providers. More information about this change will be available on our Open Enrollment information site prior to the start of the Open Enrollment period. The following dental plan rates (full-time, 12-pay schedule) will continue through September 2016:

What else do I need to know?

Effective October 1, 2015, spouses who have access to “affordable” medical coverage under their own employer’s plan will no longer be eligible for coverage on our medical plan.* The only spouses who will be eligible for coverage on our medical plan next year are those who:

- Do not have access to “affordable” coverage that provides “minimum essential value” through their own employers (see explanation below); or

- Are spouses who are employed by Albemarle County Schools or Local Government divisions.

*Please note that this does NOT apply to our dental plan, to any eligible dependent children you wish to cover on your medical plan, or spouses who are Medicare-eligible and do not have other employer coverage.

Why are we making this change?

The continued quality and affordability of our employee medical plan is one of our highest priorities. It is important to understand that we are self-insured and that our medical plan reserve (which is the fund that is used to pay all medical plan expenses) is subject to ever-increasing cost pressures that are the result of:

- the inevitable rise in health care costs

- keeping monthly premiums artificially low during recent periods of no/little salary increases

- taxes that continue to be assessed on our plans under the Affordable Care Act

- unexpected additional costs due to other area employers’ disallowing spouse coverage on their plans

This change to spouse eligibility rules is an important part of our ongoing efforts to continue to offer high quality healthcare at an affordable price to our employees, their spouses who do not have other access to quality medical coverage, and their dependent children.

How do I determine if my spouse will no longer be eligible for coverage on our medical plan?

The two standards we will use to determine whether your spouse is eligible for coverage on our medical plan are: the “affordability” and “value” (both as defined by the Affordable Care Act) of the medical plan your spouse may have access to through his/her own employer. A plan is considered to be “affordable” if the cost of the least expensive, employee only plan offered by an employer does not exceed 9.5% of the employee’s income. Let’s look a bit more at those terms:

Affordability:

In order to help you easily determine whether your spouse’s employer coverage is considered “affordable,” we have created a simple calculator that you can use. All you have to do is enter your spouse’s annual salary (use Box 1 of his/her most recent W-2) and the monthly cost to purchase his/her employer’s least expensive, employee ONLY plan. The calculator will do the rest! Open the calculator »

If you have any technical difficulties while accessing the calculator, please email branham@albemarle.org.

Value:

The Affordable Care Act (ACA) specifies that “affordable” plans must also offer “minimum essential value,” which is defined as satisfying a “60% actuarial value test.” In simpler terms, this means that a plan would pay for at least 60% of medical expenses on average for a standard population. The quickest and easiest way to determine whether your spouse’s plan meets the minimum value standard is to contact the employer and ask! Because the ACA mandates regarding employer medical plans are pretty well known at this point, an employer should be able to easily answer this question when asked.

If your spouse’s plan is determined to be “not affordable” OR if the plan does not offer “minimum essential value,” you may cover your spouse on our medical plan next year. If it is calculated to be “affordable” AND it also offers “minimum essential value”, then you may not cover your spouse next year and you MUST remove him/her during the Open Enrollment period. Please remember that if you drop your spouse from your medical plan during Open Enrollment, he/she would need to line up coverage on his/her employer plan as of October 1st. We’ll offer some helpful tips for those impacted by this change in the next benefits FOCUS—coming later this week!

In the next issue …

In the next benefits FOCUS, we’ll tell you:

- What you can expect after Open Enrollment if you have enrolled a spouse for next year

- How we can help you if your spouse must be dropped from our plan at the end of this plan year (September 30th)

- About changes to the medical Flexible Spending Account (FSA) next year (Hint: It starts with “roll” and it ends with “over.”)

- What you need to know about the coming dependent eligibility review

Human Resources staff are available to answer questions and help you through this process! Please don’t hesitate to contact us if you need assistance (434-296-5827).

For more detailed information about your employee benefits, our web pages are always available when you are.