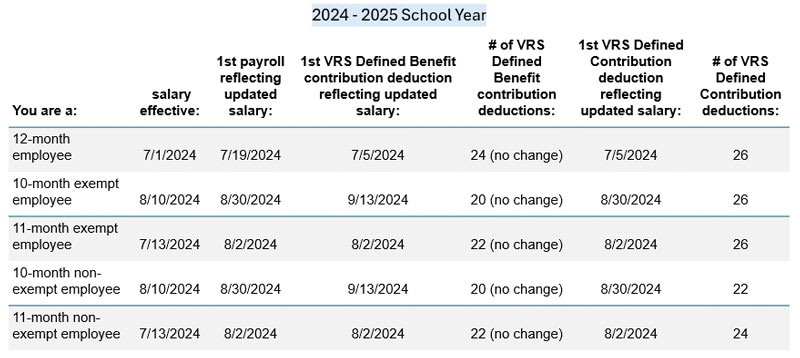

Right now, employees in the VRS Hybrid Plan have money taken from their first two paychecks each month for their Defined Contribution account. Starting July 1, 2024, VRS-participating employers are required to take both mandatory and voluntary Defined Contributions from every paycheck, even in months with three paychecks (such as August 2024 and January 2025 in the 2024-25 school year). The total yearly contribution will stay the same, but the amount taken from each paycheck will be smaller because it’s spread out over more paychecks. Here’s a summary of the deduction schedule for the 2024-25 school year:

Please note: While the Defined Contribution portion of the plan will be deducted from every paycheck (including months with three paychecks), the Defined Benefit portion of the plan will continue to be deducted only from the first two paychecks in each month.

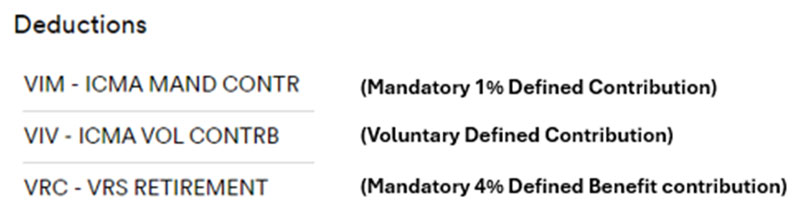

As a reminder, the VRS Hybrid Plan consists of two components: a Defined Benefit component (the “pension”) and a Defined Contribution component (the “savings”). All Hybrid Plan members are required to contribute 4% of their salary to the Defined Benefit program and 1% of their salary to the Defined Contribution component. Hybrid members have the option of contributing an additional amount to their Defined Contribution account (up to a maximum of 4% of their salary) to receive the maximum employer match (2.5%). Here is how these deductions appear on your pay statement:

Important: The new deduction schedule for Defined Contributions applies only to the VRS Hybrid Plan. Any contributions to the Lincoln ACPS 403b, COV 457 plan, or Nationwide 457 plan will continue to be deducted from the first two paychecks of each month (24 annual deductions).

Human Resources will follow up this post with targeted messages to VRS Hybrid Plan employees in the coming weeks.

Questions? Please contact the ACPS benefits team at benefits@k12albemarle.org.